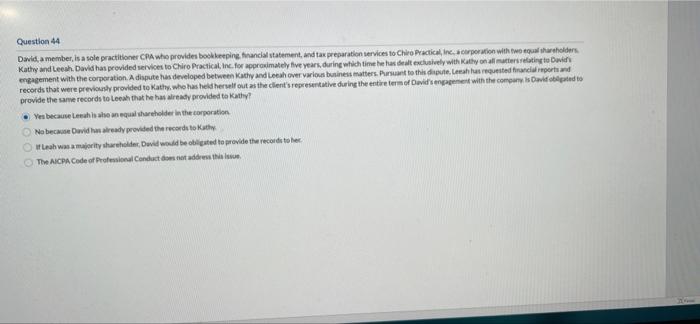

David a member is a sole practitioner cpa – David A. Member, a sole practitioner CPA, exemplifies the challenges and rewards of working independently in the accounting field. His story, marked by resilience and innovation, offers valuable insights into the unique aspects of solo practice.

As a sole practitioner, David has navigated the complexities of running a business while providing high-quality accounting services to his clients. His experiences shed light on the strategies, challenges, and opportunities that shape the lives of solo practitioner CPAs.

Introduction: David A Member Is A Sole Practitioner Cpa

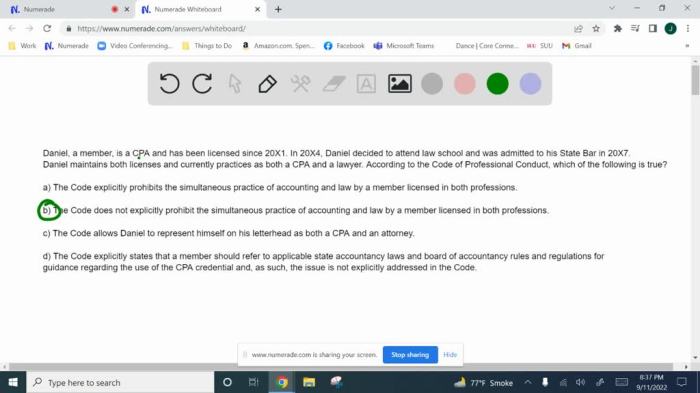

A sole practitioner CPA is an individual who provides accounting, tax, and financial advisory services without being part of a larger accounting firm. They are self-employed and responsible for all aspects of their business, from marketing and client acquisition to tax preparation and financial planning.

Sole practitioner CPAs face unique challenges, such as the need to manage their own time and resources, develop a strong marketing strategy, and stay up-to-date on industry trends and regulations.

Marketing and Business Development

Effective marketing and business development are crucial for sole practitioner CPAs to attract and retain clients. They need to develop a strong brand identity, create a professional website, and utilize social media to promote their services.

- Identify target clients and develop targeted marketing campaigns.

- Build relationships with other professionals and businesses to generate referrals.

- Attend industry events and participate in networking opportunities.

Financial Management

Financial management is essential for sole practitioner CPAs to ensure their business is profitable and sustainable. They need to track expenses, manage cash flow, and set aside funds for taxes and retirement.

- Create a budget and track expenses regularly.

- Set competitive rates for services and negotiate payment terms.

- Use accounting software to automate tasks and improve efficiency.

Technology and Automation, David a member is a sole practitioner cpa

Technology and automation can help sole practitioner CPAs improve efficiency and productivity. They can use software for tax preparation, accounting, and financial planning.

- Implement a cloud-based accounting system to access data from anywhere.

- Use automated invoicing and payment processing systems.

- Utilize social media automation tools to schedule posts and engage with clients.

Questions and Answers

What are the key challenges faced by sole practitioner CPAs?

Sole practitioner CPAs often face challenges in areas such as business development, financial management, and maintaining a work-life balance.

How can sole practitioner CPAs effectively market their services?

Effective marketing strategies for sole practitioner CPAs include networking, online presence, and building relationships with referral sources.

What are the best practices for financial management for sole practitioner CPAs?

Best practices include maintaining accurate records, managing expenses effectively, and utilizing accounting software to streamline processes.